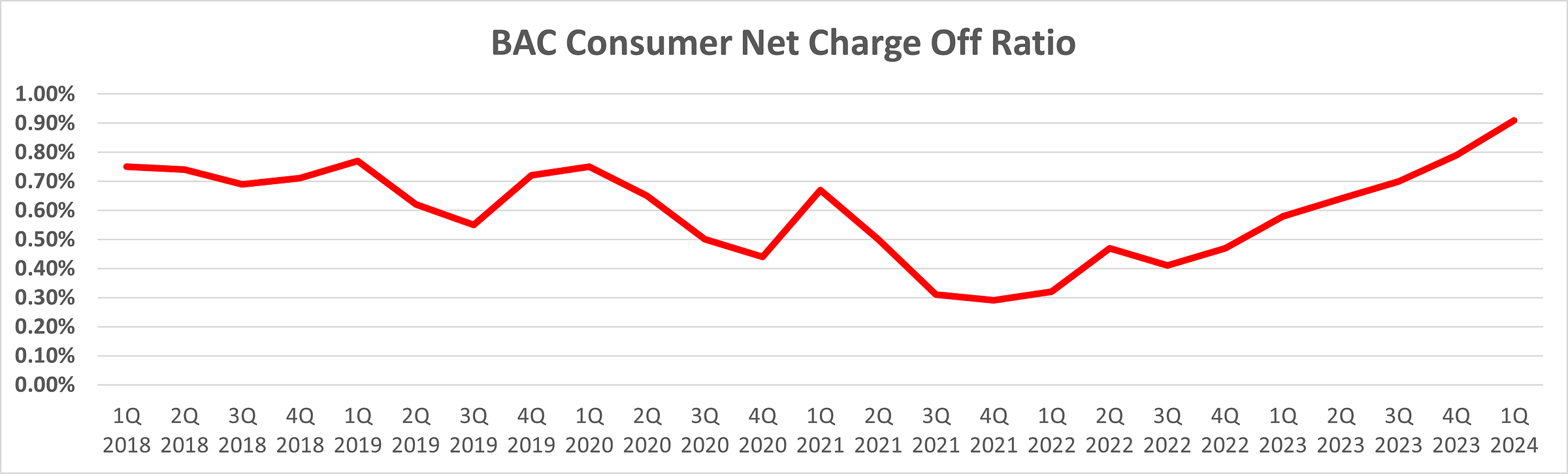

Bank of America's Consumer Net Charge Offs Are At Their Highest Level Since 2013

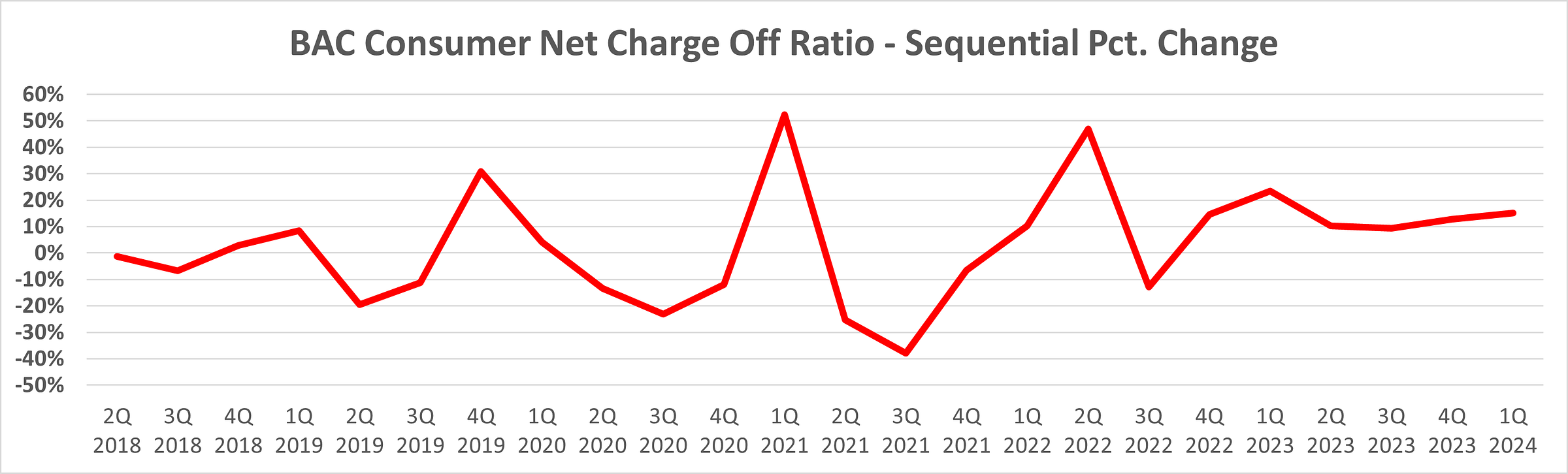

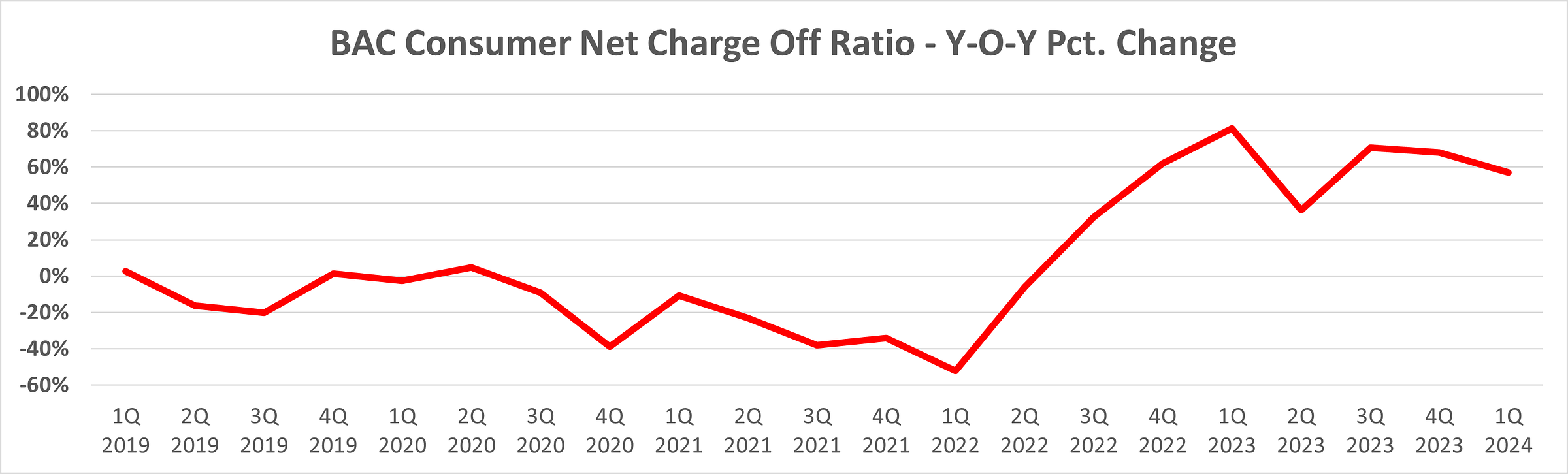

Bank of America’s Consumer business has not seen a 1% Net Charge Off ratio since 2013 (it currently stands at 0.9%). With job cuts looming and rates elevated, my bet is that the Consumer will blow past a 1% NCO ratio soon.

For perspective, BAC’s Consumer NCO ratio peaked in 2008 at 6.2%. Heck, the Consumer NCO was at 2.4% in 2012. Since then, the Consumer has piled on a net debt position. Why wouldn’t a 3% NCO be in the cards by 2025? I know, I know… the U.S. is now bailout happy. However, there is no free lunch. Every U.S. Government bailout - fiscal or monetary - only adds to the Treasury debt outstanding. At some point investors in U.S. Treasuries will want much higher yields given that the U.S. is technically insolvent.

Keep reading with a 7-day free trial

Subscribe to TEK2day to keep reading this post and get 7 days of free access to the full post archives.