Bank of America's Unrealized Losses Pile Up and Will Be A Reason Why The Fed Lowers Rates

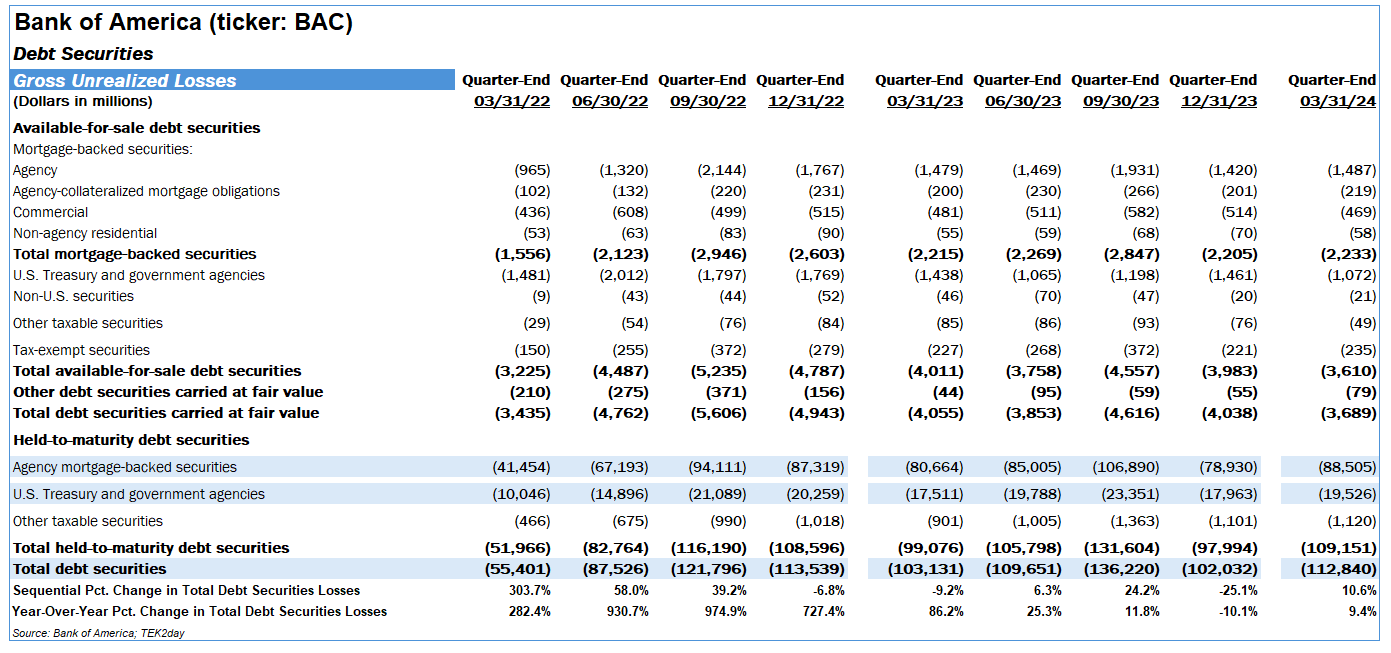

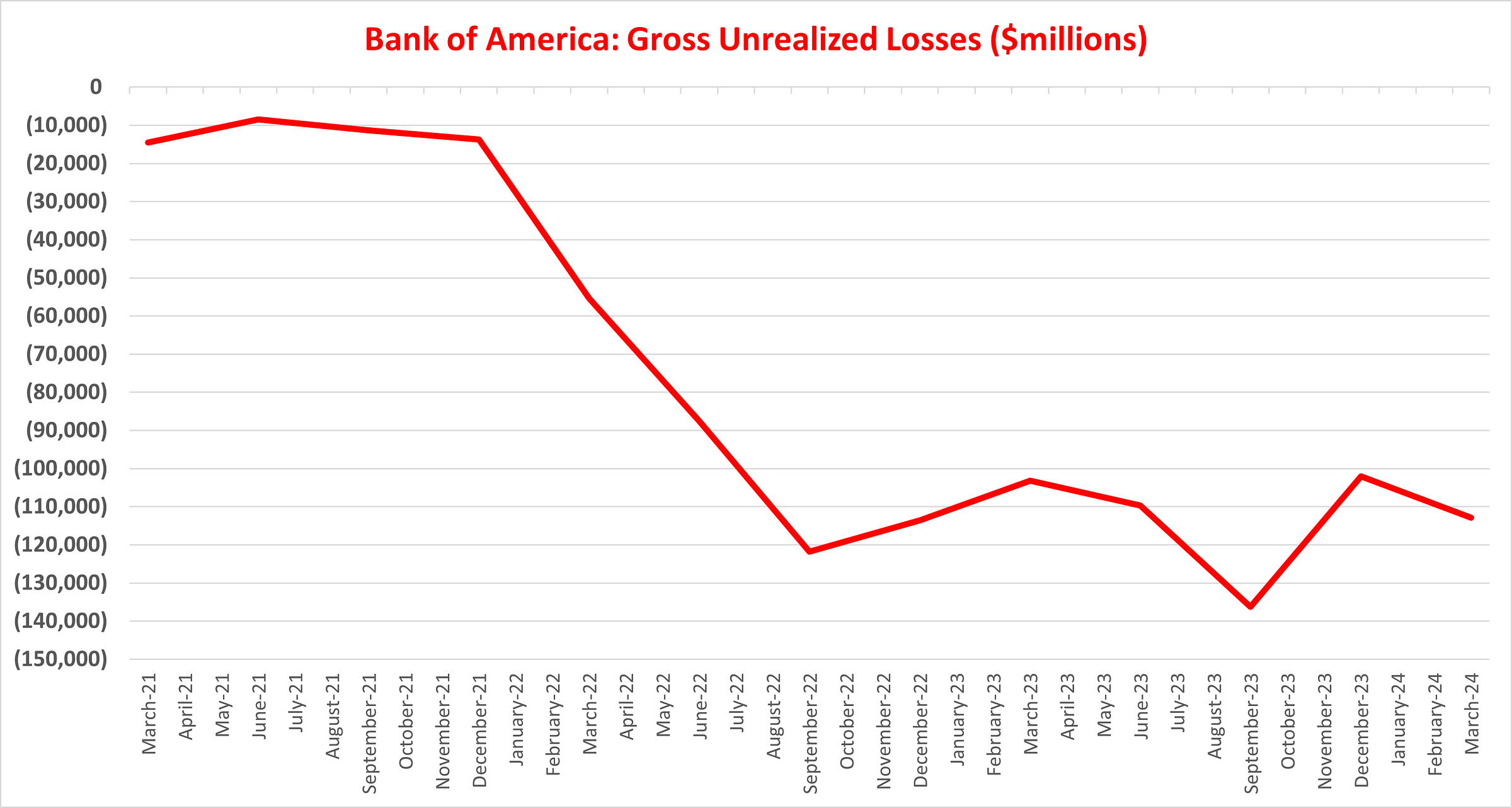

Bank of America’s unrealized losses increased to $113 billion as yields moved higher since BAC’s December earnings report. This is the highest unrealized loss level since September 2023’s $136 billion figure. Unrealized losses will cause BAC to become more conservative in its lending practices and will be one of the reasons why the Fed will lower interest rates. Reinflating the debt market would help the banks by reducing the level of unrealized losses. In the meantime, yields are poised to move higher as we predicted last year.

Premium TEK2day subscribers may access the Excel version of the below table and chart.

Keep reading with a 7-day free trial

Subscribe to TEK2day to keep reading this post and get 7 days of free access to the full post archives.