Federal Reserve Weekly SOMA Update

The market drama this week was less about tariffs and more about Elon Musk pushing back on the Trump Administration’s profligate fiscal spending bill, which will likely generate a $2.0-2.5 Trillion deficit for fiscal 2025 (which was locked-in by March’s Continuing Resolution), thereby maintaining the Biden Administration’s unsustainable spending levels. Consider how the Dollar has lost value against hard assets, most notably gold, as a consequence of the profligate fiscal spending that has endured since 2H 2020. Treasury owes debt holders $37 Trillion, not to mention another approximately $70 Trillion in unfunded liabilities (Social Security, Medicare and Medicaid). The Fed has a role to play here. It could be the adult in the room (Scott Bessent isn’t). For example, former Fed Chair Arthur Burns is known for easing monetary policy too early in the 1970’s, having prematurely declared victory against inflation. However, Burns is not as well known for threatening Congress that if it failed to curb spending, the Fed would be forced to tighten monetary policy. Jerome Powell does not have the spine to use monetary policy as a tool to curb fiscal spending. After all, he grew up in the Private Equity industry and is therefore a credit perma-dove.

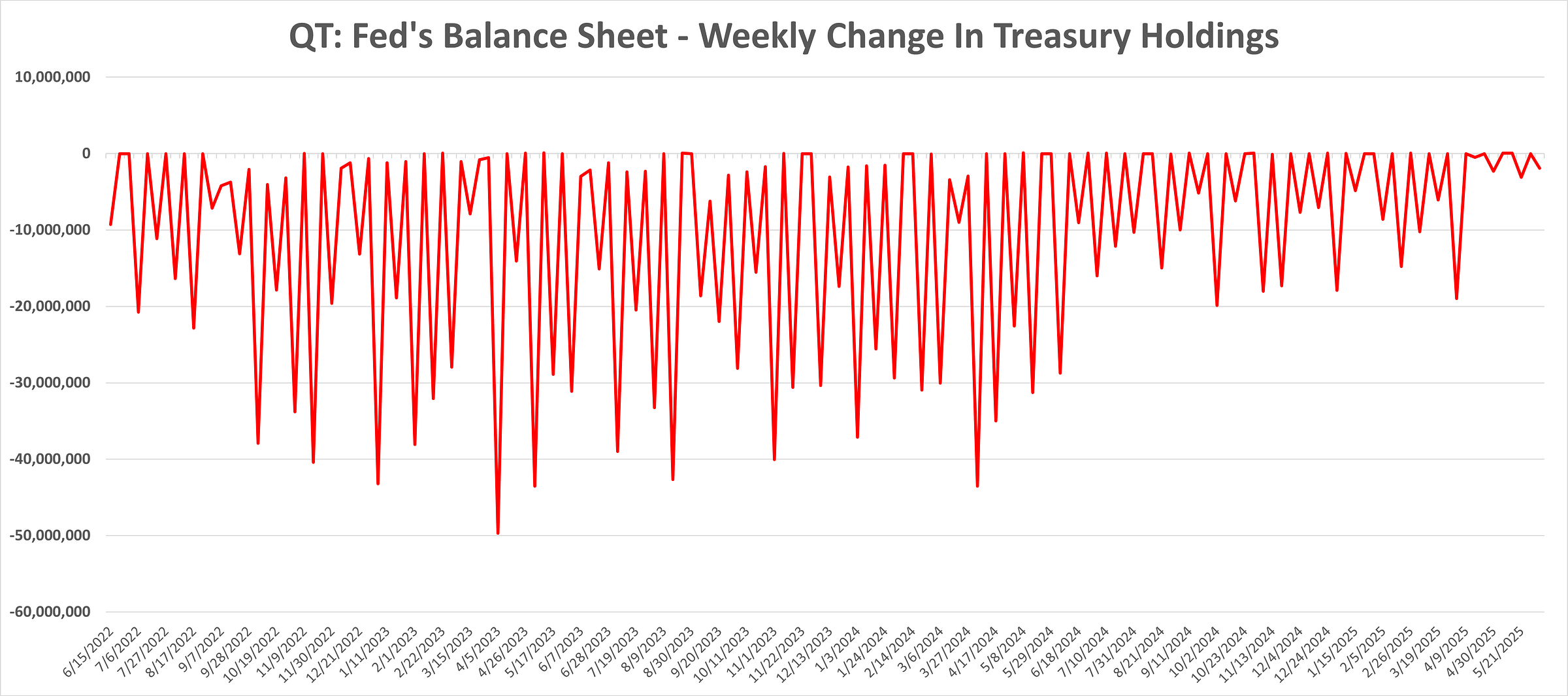

Treasuries: The Fed’s Treasury holdings decreased by $1.9 billion for the week-ended June 4th. The Fed’s Treasury holdings decreased by $4.9 billion on a rolling 4-week basis.

Agencies: The Fed’s Government Agency security holdings were unchanged for the week-ended June 4th. The Fed’s Government Agency holdings decreased by $16.8 billion on a rolling 4-week basis.

The Fed’s balance sheet holdings: https://www.newyorkfed.org/markets/soma-holdings

Our Excel spreadsheet tracks the Fed’s SOMA activity since 2022. It may be accessed below the paywall.

Keep reading with a 7-day free trial

Subscribe to TEK2day to keep reading this post and get 7 days of free access to the full post archives.