Federal Reserve Weekly SOMA Update

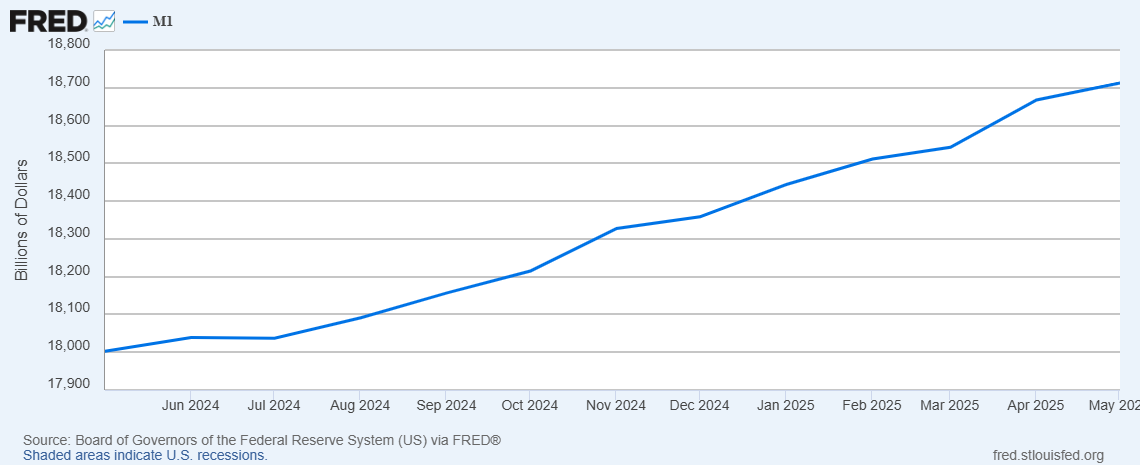

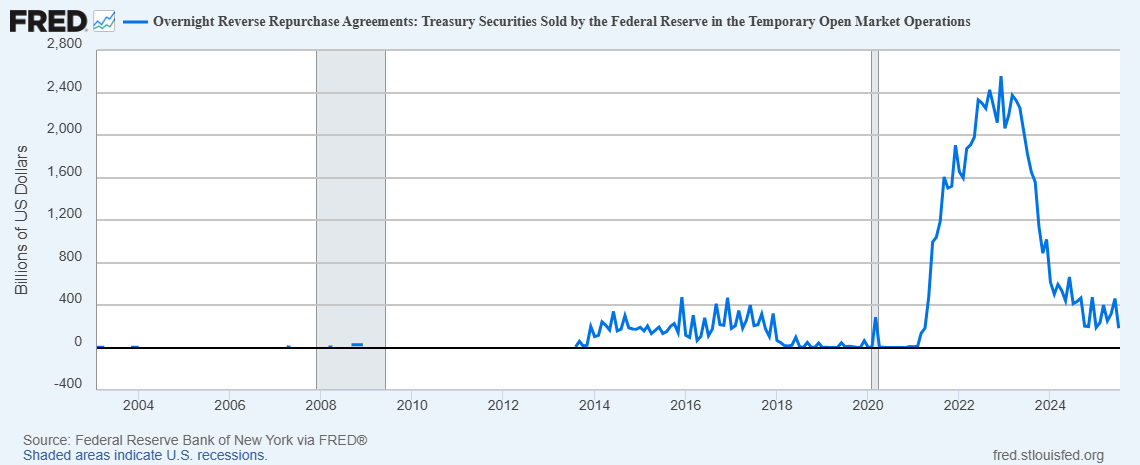

The Fed took the week off and next meets on July 29th and 30th. Powell & Company never did its job in terms of truly tightening the money supply after it expanded M1 and M2 at a record pace in the period from April 2020-May 2022. The Fed is now prepared to lower rates (QT has essentially stopped), at a time when the fiscal side of the house continues to operate at record deficit levels. This can only mean price inflation for goods and services will continue. The second chart below shows that the Federal Reserve system has grown M1 at a healthy pace over the past year after it took away the banking systems’ BTFP crutch in March 2024. The Fed has had some form of QE running in the background since it started its balance sheet runoff. Heck, even the overnight reverse repo market is still humming along (3rd chart). The fiscal and monetary sides are creating such a frothy environment that if in fact the 10-year Treasury yield breaks away, no amount of yield curve control will contain it. U.S. Government paper simply is not the safest global asset regardless of U.S. propaganda. I prefer gold and any mineral with utility to U.S. debt and fiat currency. Imagine if the U.S. was a NASDAQ-listed company that consistently grew debt faster than revenues and that has had negative earnings for the past 25 years. Oh, don’t worry, the company can issue new debt to cover deficits and pay off the old debt. What would you want in return? More than 4.5%? That’s exactly why I believe the 10-Year Treasury Yield will move directionally higher over the next 1, 3, 5, 7, 10, 20-year period - pick your poison.

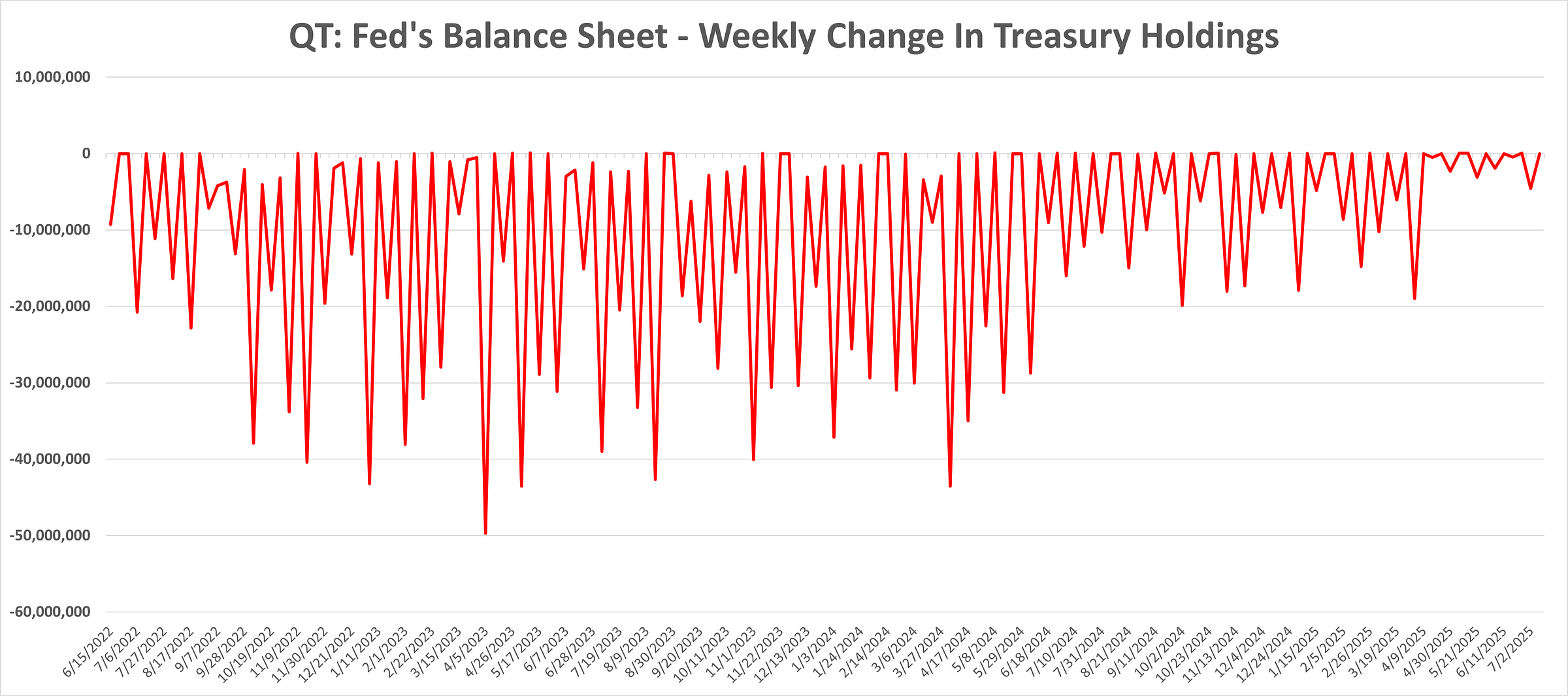

Treasuries: The Fed’s Treasury holdings were unchanged decreased for the week-ended July 9th. The Fed’s Treasury holdings decreased by $5.0 billion on a rolling 4-week basis.

Agencies: The Fed’s Government Agency security holdings were unchanged for the week-ended July 9th. The Fed’s Government Agency holdings decreased by $17.7 billion on a rolling 4-week basis.

The Fed’s balance sheet holdings: https://www.newyorkfed.org/markets/soma-holdings

Our Excel spreadsheet tracks the Fed’s SOMA activity since 2022. It may be accessed below the paywall.

Keep reading with a 7-day free trial

Subscribe to TEK2day to keep reading this post and get 7 days of free access to the full post archives.