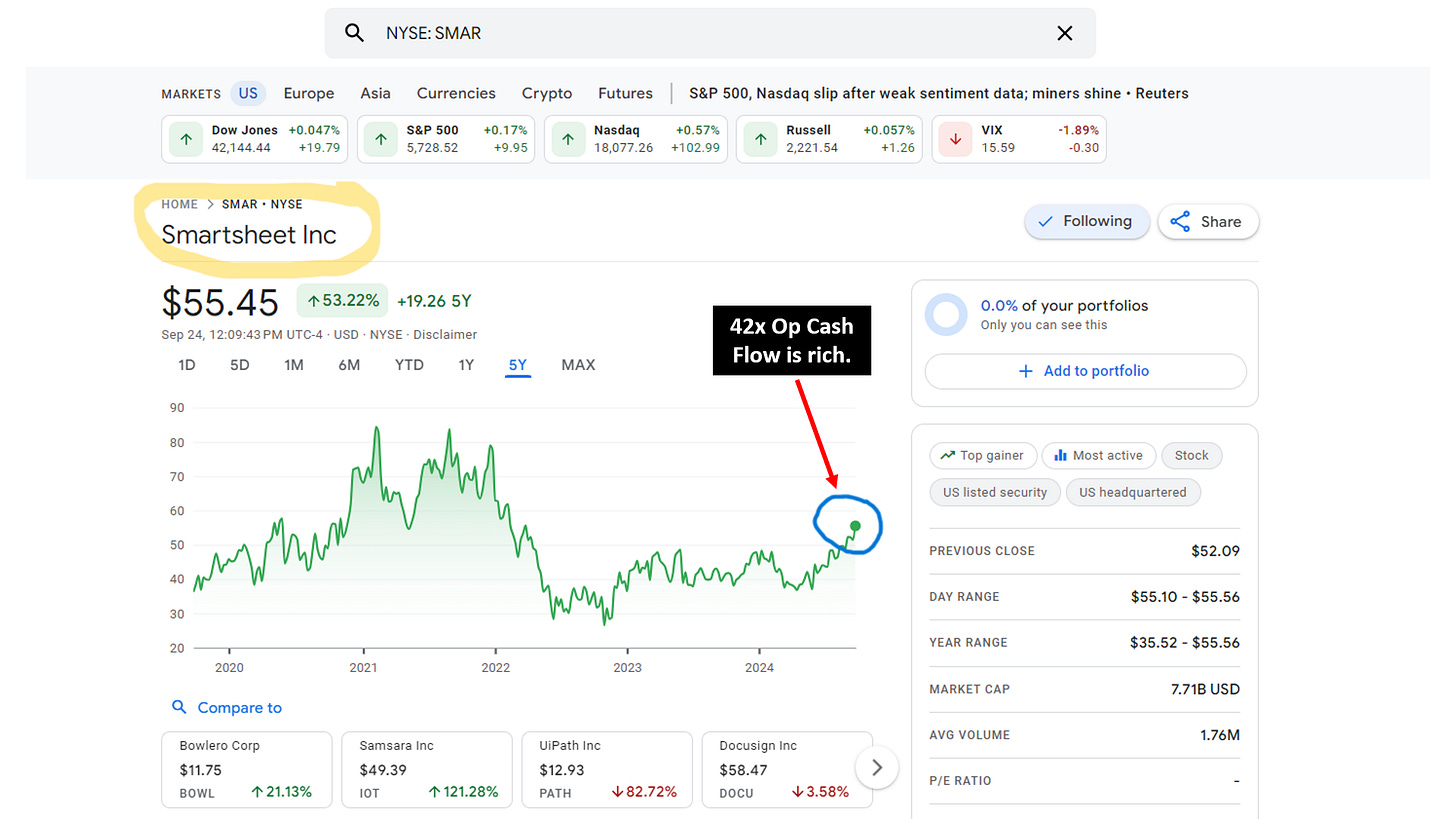

Smartsheet (SMAR) Deal Highlights Post-COVID Interventionist Market Distortions

Blackstone and Vista agreed to acquire Smartsheet (SMAR) for 42x cash flow.

Blackstone (BX) and Vista Equity agreed to acquire SMAR for $8.4 billion, or approximately 42x Operating Cash Flow (OCF) (HERE).

Let’s assume that OCF = EBITDA for purposes of this discussion. Let’s assume that Blackstone and Vista cut OpEx by 50%, that is to say increase SMAR’s cash flow by 50%. That’s still a 21x EBITDA multiple, which is rich in my view.

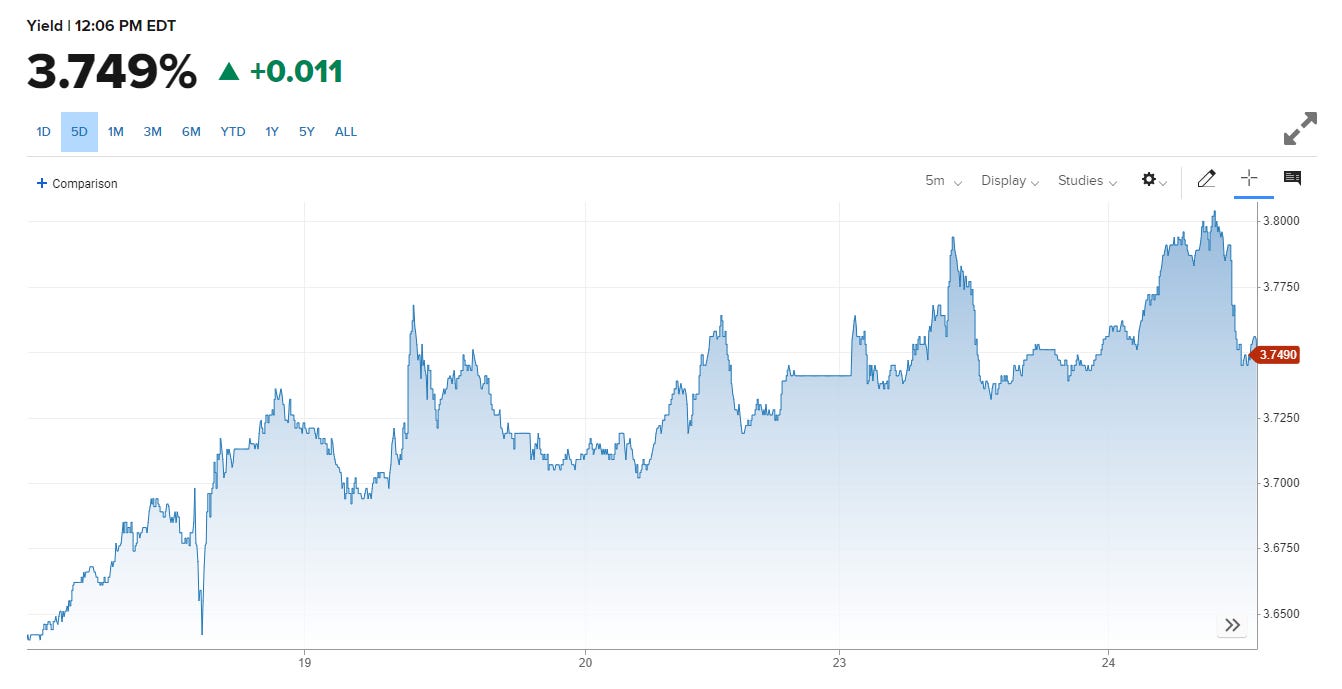

The Fed’s easy monetary policy since 2009 (see charts below) combined with recent fiscal deficit spending has created a valuation bubble that has grown ever larger since 2009, especially since 2020. There is inherent downside risk to company valuations when Government policy drives valuations higher rather than Revenue and Earnings growth.

Here is the Trillion-Dollar question: What are Private Equity firms going to do if the Bond market decides it does not trust Congress’ fiscal policies nor the Fed’s easy monetary policy and demands higher yields on long bonds? (see 10-year chart below).

In other words, PE firms could be under water for a very long time on deals made since 2020 if over the next 3-6 months the Fed lowers rates, yet the long-end of the yield curve moves higher and stays higher. That will pull company valuations, housing prices and other prices much lower - something the Fed failed to do with its anemic QT program and rate hikes.

Keep reading with a 7-day free trial

Subscribe to TEK2day to keep reading this post and get 7 days of free access to the full post archives.