Solera (SLRA) Model

We built a Solera (SLRA) model.

All TEK2day subscribers may view a PDF of our SLRA model HERE.

Premium TEK2day subscribers may view the Excel version below the paywall.

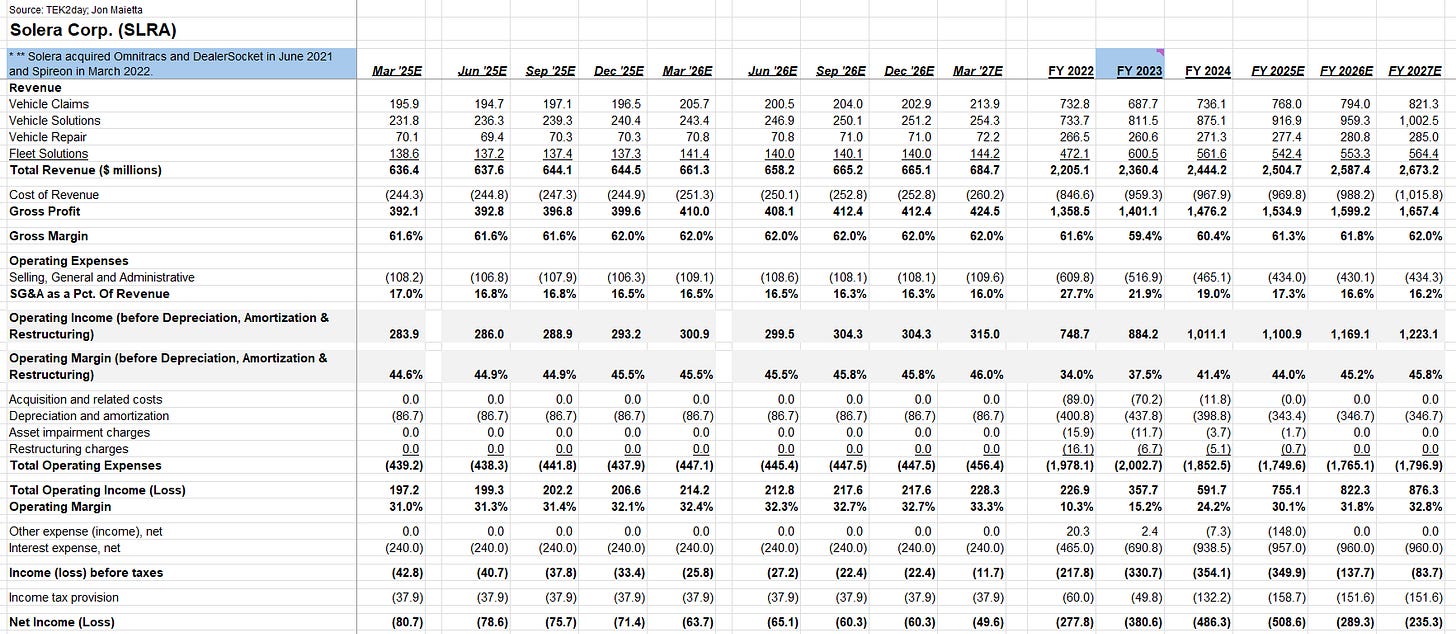

We modeled revenues and related expenses through fiscal year 2027. We captured revenue and adjusted EBITDA by reportable segment. We also modeled cash flow over the same period.

Our model is not a pro forma model. It does not reflect a potential IPO.

When private equity firms value a company, they allocate the most weight to trailing EBITDA as they define EBITDA. Public company investors are different in that they prefer cash flows to EBITDA when working through a valuation analysis.

For a low-to-mid single digit percentage organic revenue grower such as Solera where operating cash flow is only approximately 20% of adjusted EBITDA in a given year, I would not apply a generous Enterprise Value to Cash Flow multiple on SLRA shares. I say this knowing that the collective equity market has lost its mind when it comes to valuation. Everything looks expensive to me in this equity market. A massive haircut is long overdue.

I do prefer SLRA’s business to CCCS given that Solera has greater diversification in terms of its product portfolio and customers - including customer geographic diversification.

Keep reading with a 7-day free trial

Subscribe to TEK2day to keep reading this post and get 7 days of free access to the full post archives.