The Big Four Banks and The Fed

JP Morgan (JPM), Bank of America (BAC), Wells Fargo (WFC) and Citigroup (C) will report earnings Friday morning. At that time we will get a glimpse as to what may have spooked the Fed enough for Fed Chair Powell to have taken his dovish turn at the Fed’s December 13th FOMC meeting.

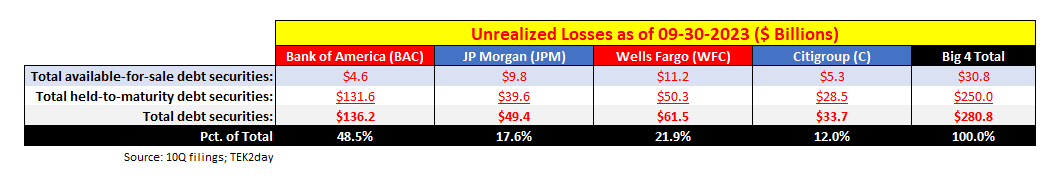

My view is that Powell was spooked by banks’ unrealized loss levels which were at $684 billion as of September 30th 2023 (BAC alone had $136 billion of unrealized losses). Those losses may have further increased between September 30th and December 13th when Powell spoke. Unrealized losses likely have abated since Powell’s dovish comments, but likely remain elevated such that banks may pull back on extending credit, especially if the Fed was to allow the Bank Term Funding Program (BTFP) to expire on March 11th. We expect the Fed to renew the BTFP on March 11th as we believe many banks would fail and that the U.S. economy would have a “hard landing” without it.

Below are the unrealized losses for the Big 4 banks.

The Excel version of the below table plus additional detail on unrealized losses per bank is available after the paywall break.

Related TEK2day Podcast (Ep. 455): HERE or below.

Keep reading with a 7-day free trial

Subscribe to TEK2day to keep reading this post and get 7 days of free access to the full post archives.