The Fed Will Bail Out BofA with Lower Rates

We have written about Bank of America’s debt investment portfolio being underwater for two years now and the Fed having to bail out Brian Moynihan’s bank with lower rates as a result (which is why we previously called for Moynihan’s dismissal).

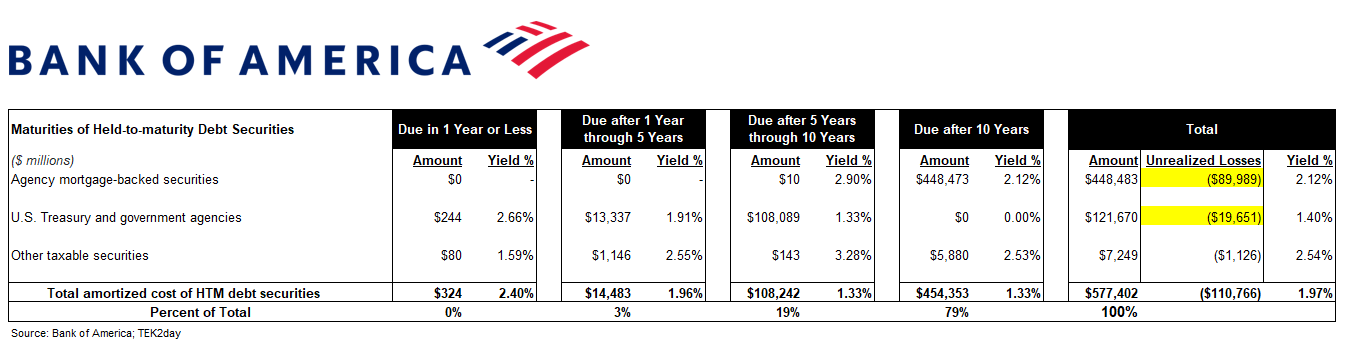

The table below details how BAC’s low-yielding investment portfolio will be a problem for the bank for over a decade unless the Fed bails out the bank with lower rates (lower interest rates will inflate the price of debt securities given the inverse nature of prices and interest rates).

The other option would be for Moynihan to take his punches and start to rid BAC’s balance sheet of underwater debt securities as other banks have done.

Given that Moynihan has not been proactive to this point, our view is that he will wait for the Fed to lower rates, thus bailing out BAC.

It is also our view that the Fed will lower rates much faster than it is letting on. Our position is that the Fed will have its Fed Funds rate below 2% next year to bail out the banks, to bail out the debt-funded U.S. economy and to ease the interest expense burden on the U.S. Treasury’s $35 Trillion debt load. If the Fed is in fact slow to lower rates and stop at around 3%, BAC will be in for a long decade, or will have to swallow a bitter pill and take enormous losses.

Keep reading with a 7-day free trial

Subscribe to TEK2day to keep reading this post and get 7 days of free access to the full post archives.