The Fed’s Balance Sheet Reduction (QT) Update

The Fed has turned on “inflation mode” to medium. The money supply is growing. The Fed is lowering Fed Funds. All that remains is for the Fed to initiate a formal new QE program (BTFP was back door QE). The Fed will be easing in the coming weeks as Treasury issues new debt and the Fed absorbs a portion of it. Once that 10-YR Treasury yield crosses 5%, the Fed will panic and kick-start QE. Once Government intervention is accepted in private markets, it is extremely difficult to purge. Market participants ought to be up in arms, as there is great cost associated with easy monetary policy. The U.S. is circa 2008 Venezuela in the making.

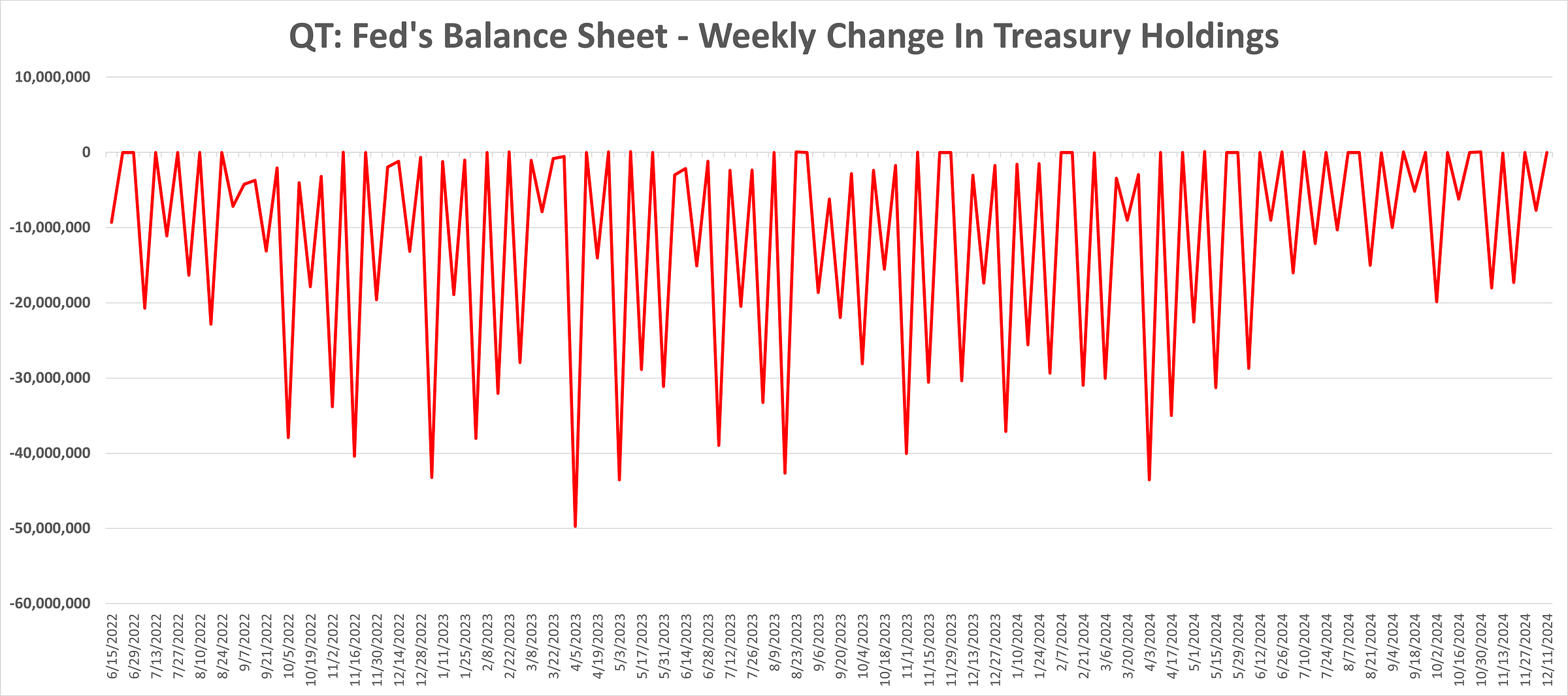

Treasuries: The Fed’s Treasury holdings were unchanged for the week-ended December 11th. The Fed’s Treasury holdings declined by $25.0 billion on a rolling 4-week basis.

Agencies: The Fed’s Government Agency security holdings were unchanged for the week-ended December 11th. The Fed’s Government Agency holdings declined by $17.0 billion on a rolling 4-week basis.

The Fed’s balance sheet holdings: https://www.newyorkfed.org/markets/soma-holdings

Keep reading with a 7-day free trial

Subscribe to TEK2day to keep reading this post and get 7 days of free access to the full post archives.