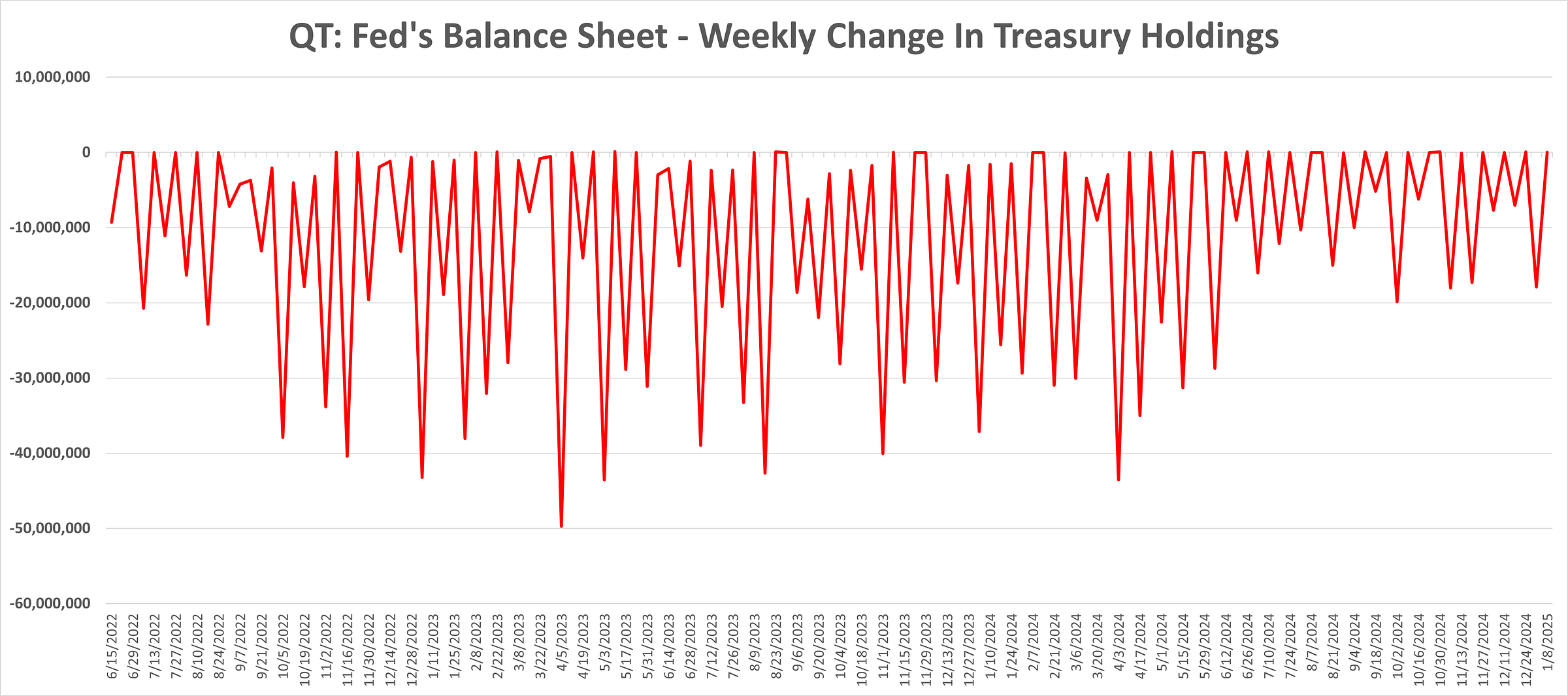

The Fed’s Balance Sheet Reduction (QT) Update

The Fed made modest Treasury purchases this week. When, not if, the 10-year Treasury yield hits 5%, the Fed will start to buy 10-year Treasuries at scale (i.e., “QE”). Further, I expect the Big Banks to report larger unrealized losses when they report December quarter results next week as compared to September quarter results given the increase in yields over the past several months. Bank of America (BAC) has suffered significant opportunity cost as a result of not having rid its balance sheet of those unrealized losses, which are primarily mortgage securities, for which BAC had $70 billion in unrealized losses as of the September 2024 quarter. Those securities ought to have been sold off months ago and replaced with higher yielding securities.

Treasuries: The Fed’s Treasury holdings increased by $25.0 million for the week-ended January 8th. The Fed’s Treasury holdings declined by $24.9 billion on a rolling 4-week basis.

Agencies: The Fed’s Government Agency security holdings were unchanged for the week-ended January 8th. The Fed’s Government Agency holdings declined by $15.7 billion on a rolling 4-week basis.

The Fed’s balance sheet holdings: https://www.newyorkfed.org/markets/soma-holdings

Keep reading with a 7-day free trial

Subscribe to TEK2day to keep reading this post and get 7 days of free access to the full post archives.