The Fed’s Balance Sheet Reduction (QT) Update

The Fed took no action during the week-ended February 12th 2025. My view is that the Fed ought to allow its Fed Funds Rate to float. The Central Bank ought to focus on pulling more liquidity out of the system via QT. The overnight reverse repo facility is down to $67.8 billion after peaking north of $2 Trillion. That is a positive development. The BTFP bailout expired in March 2024. The monetary policy props are gone. Hopefully, the fiscal side of the house will not artificially prop up the economy. Now is a suitable time for the Fed to tighten. However, the Fed chose to do nothing.

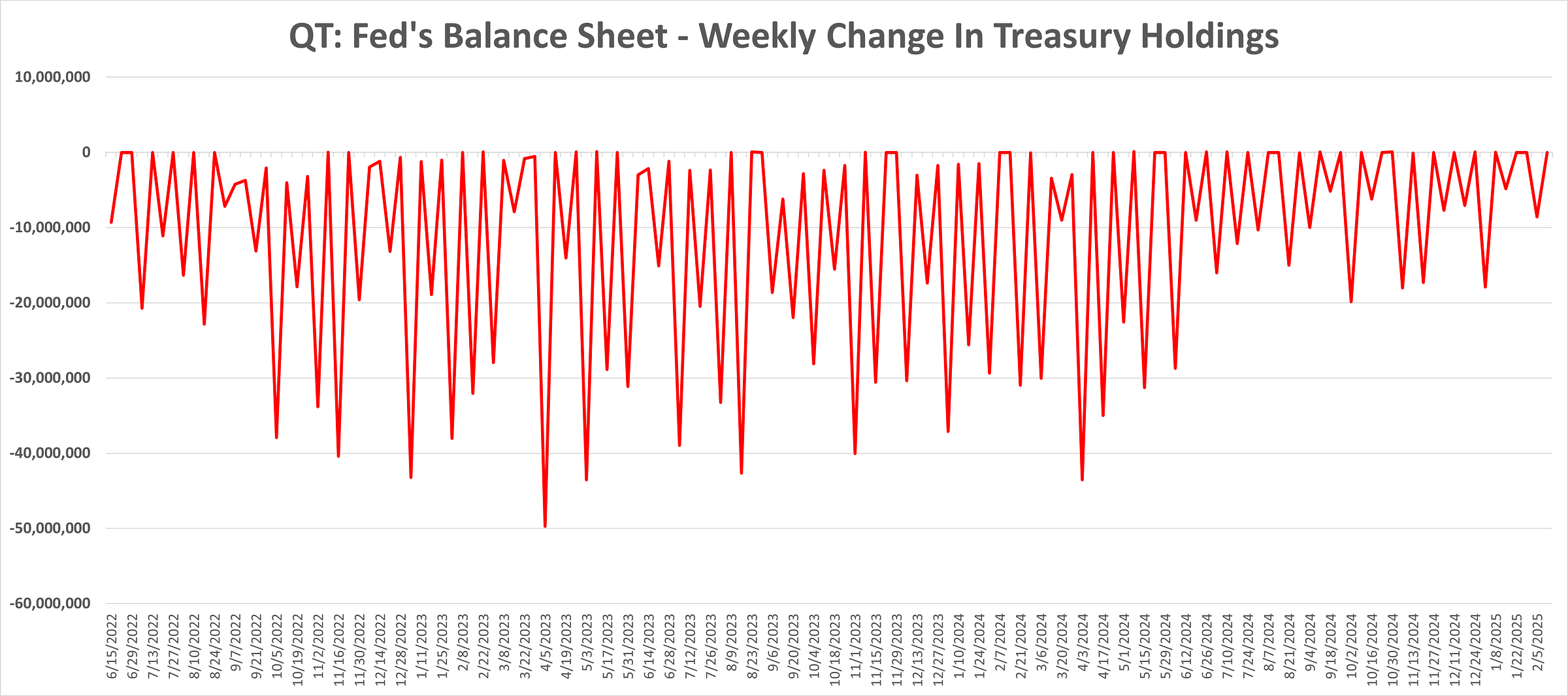

Treasuries: The Fed’s Treasury holdings were unchanged for the week-ended February 12th. The Fed’s Treasury holdings declined by $8.6 billion on a rolling 4-week basis.

Agencies: The Fed’s Government Agency security holdings were unchanged for the week-ended February 12th. The Fed’s Government Agency holdings declined by $15.7 billion on a rolling 4-week basis.

The Fed’s balance sheet holdings: https://www.newyorkfed.org/markets/soma-holdings

Keep reading with a 7-day free trial

Subscribe to TEK2day to keep reading this post and get 7 days of free access to the full post archives.