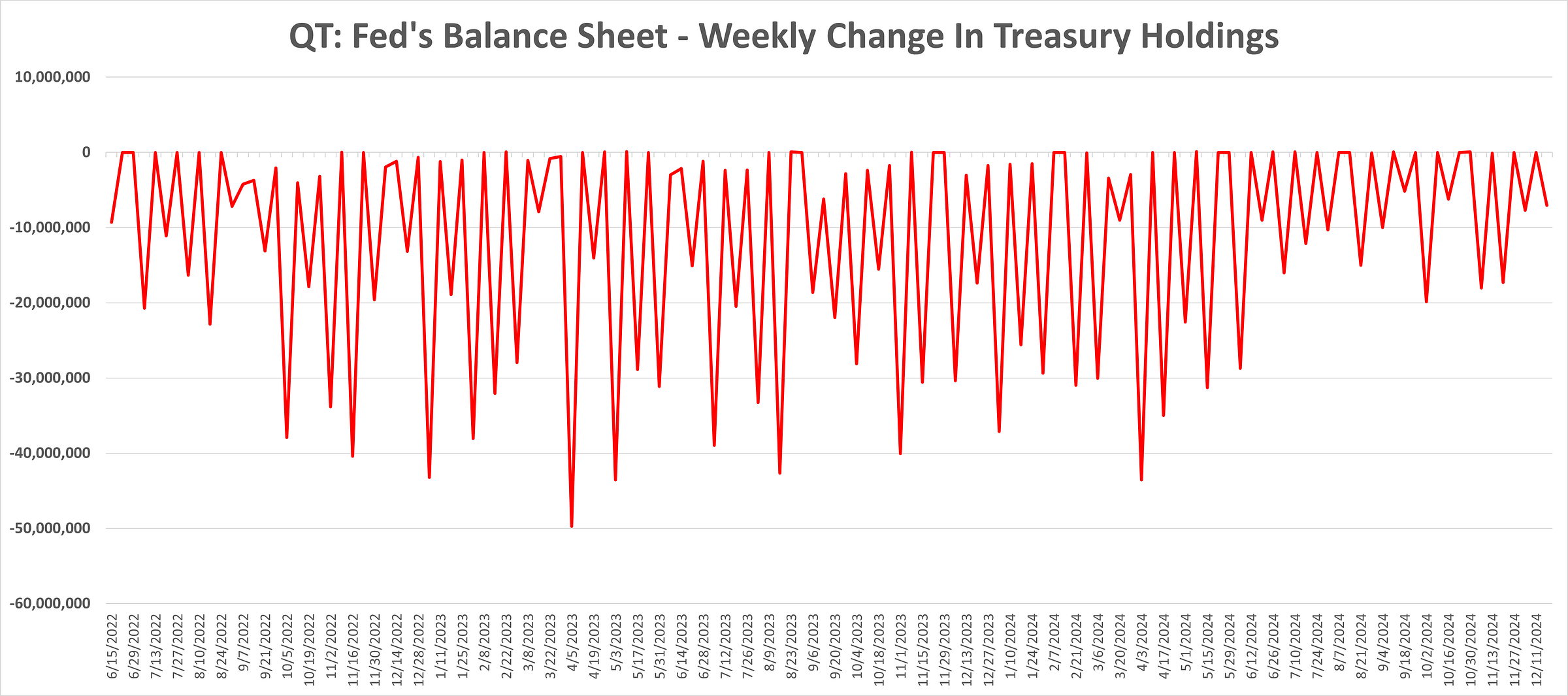

The Fed’s Balance Sheet Reduction (QT) Update

The Fed bought T-Bills and sold T-Bonds and mortgage securities for the week-ended December 18th 2024. This during a week when the Fed once again lowered Fed Funds, while issuing more conservative rate guidance for 2025. Long rates will move higher in our view - 5% will be crossed in Q1 2025 - and I anticipate the Fed will engage in QE in 2025. Otherwise, Treasury will be forced to primarily finance the Federal Government with T-Bills.

Treasuries: The Fed’s Treasury holdings declined by $7.1 billion for the week-ended December 18th. The Fed’s Treasury holdings declined by $14.8 billion on a rolling 4-week basis.

Agencies: The Fed’s Government Agency security holdings declined by $195 million for the week-ended December 18th. The Fed’s Government Agency holdings declined by $13.5 billion on a rolling 4-week basis.

The Fed’s balance sheet holdings: https://www.newyorkfed.org/markets/soma-holdings

Keep reading with a 7-day free trial

Subscribe to TEK2day to keep reading this post and get 7 days of free access to the full post archives.