The Fed’s Balance Sheet Reduction (QT) Update

The 10-year Treasury yield continued to do the Fed’s tightening work and increased to 4.21%. The Fed is too political to do the will of the people and is instead a perma-dove that works to fuel the United States’ debt-fueled markets at the expense of the Dollar. The only way this game ends is with a worthless Dollar, as has been the case with every fiat currency in human history. Until then, we get to enjoy reduced purchasing power in perpetuity. Unless of course the people demand fiscal and monetary austerity. Premium subscribers may view our Excel file below the paywall.

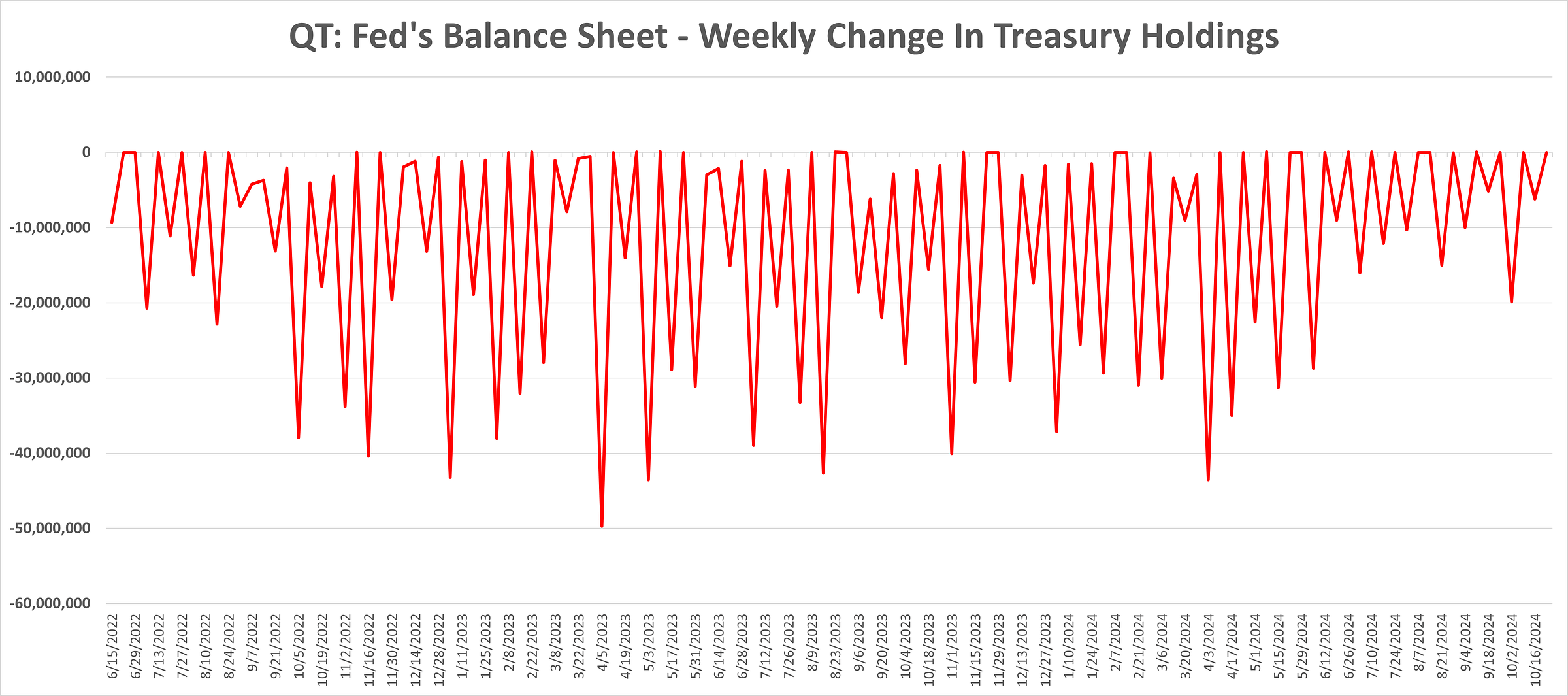

Treasuries: The Fed’s Treasury position for the week-ended October 23rd was unchanged. The Fed’s Treasury holdings declined by $26.1 billion on a rolling 4-week basis.

Agencies: The Fed decreased its Government Agency security holdings by $3.5 billion for the week-ended October 23rd. The Fed decreased its Government Agency holdings by $3.5 billion on a rolling 4-week basis.

The Fed’s balance sheet holdings: https://www.newyorkfed.org/markets/soma-holdings

Keep reading with a 7-day free trial

Subscribe to TEK2day to keep reading this post and get 7 days of free access to the full post archives.