The Fed’s Balance Sheet Reduction (QT) Update

If the Trump Administration runs fiscal deficits at the level that the U.S. has run them since 2020, the Dollar will likely lose another 40% versus gold (which interestingly is the amount that M2 has grown over the past 5 years). The Fed is the one institution that can check out-of-control fiscal spending. Should the Fed fail to do so over the next four years, it is likely that 10 YR Treasury yields will climb to the 8-10% range. Powell’s Fed has bowed to Treasury during his time as Fed Chair, which not only did not address the weak Dollar (i.e., inflation) nor the Treasury Debt problem, but it also allowed these two critical problems to worsen.

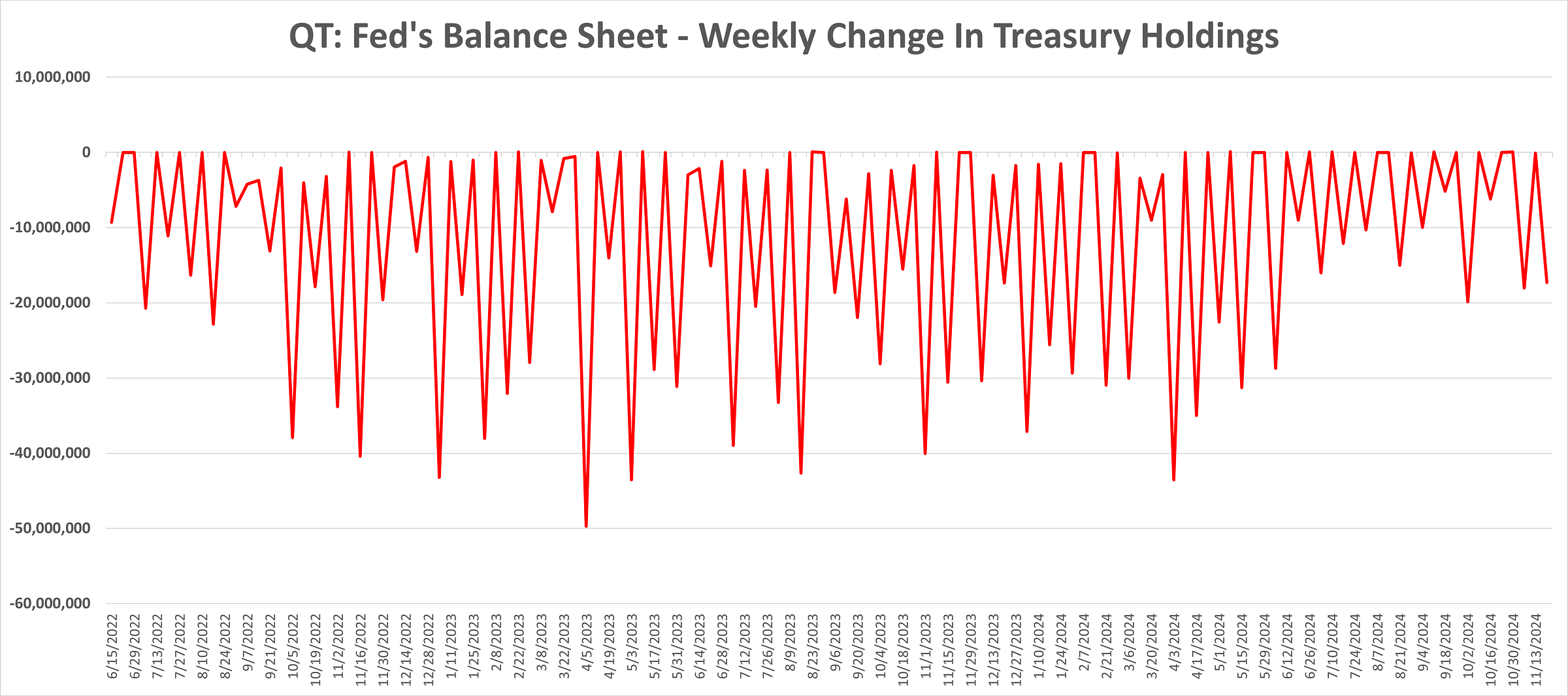

Treasuries: The Fed decreased its Treasury holdings for the week-ended November 20th by $17.3 billion. The Fed’s Treasury holdings declined by $35.3 billion on a rolling 4-week basis.

Agencies: The Fed’s Government Agency security holdings declined by $3.7 billion for the week-ended November 20th and declined by $16.3 billion over the same period.

The Fed’s balance sheet holdings: https://www.newyorkfed.org/markets/soma-holdings

Keep reading with a 7-day free trial

Subscribe to TEK2day to keep reading this post and get 7 days of free access to the full post archives.