The Fed’s Balance Sheet Reduction (QT) Update

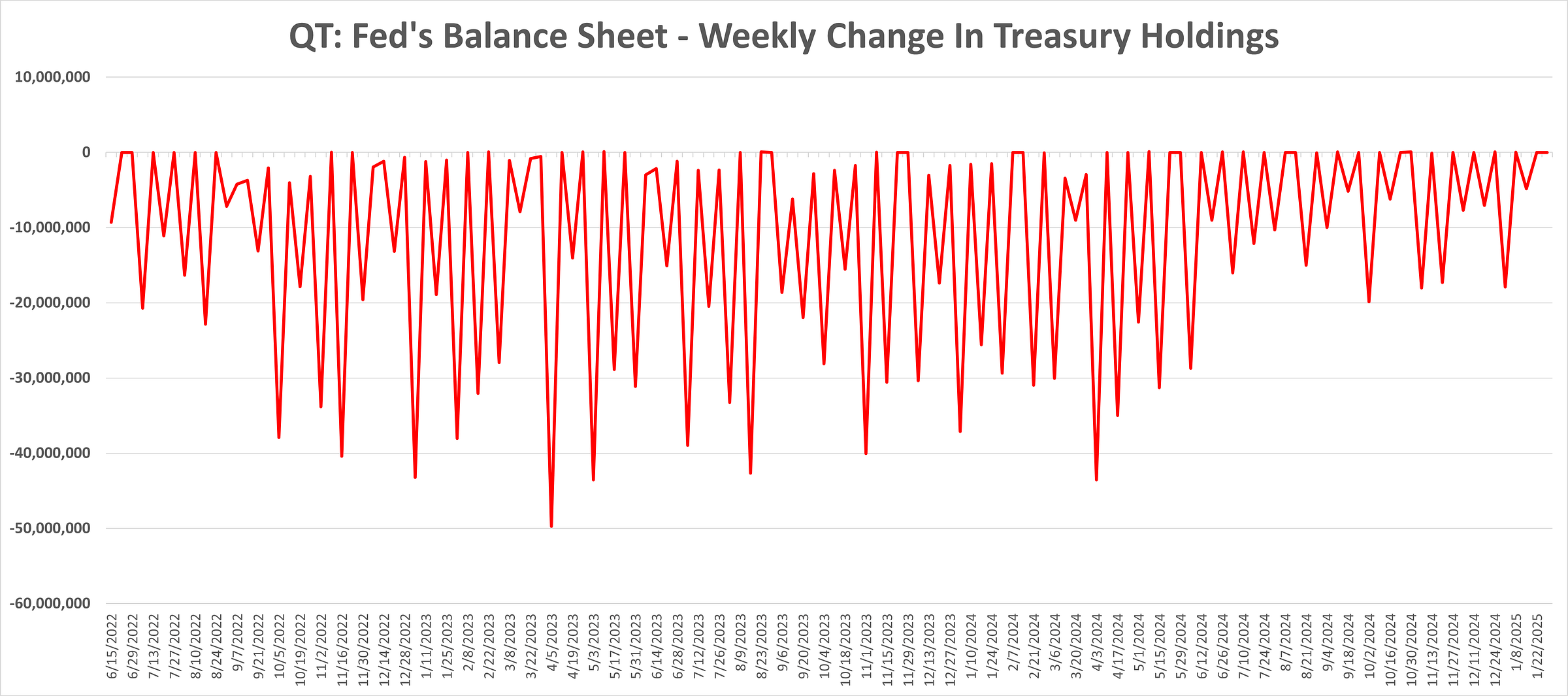

The Fed has frozen its Treasury position for the second consecutive week. The Fed has essentially taken a reactionary stance toward monetary policy with its general policy bent leaning toward dovish given that M2 continues to expand while the Fed Funds rate and Treasury holdings remain flat. The Fed’s culling of mortgage securities is too little, approximately four years too late. I expect long yields to remain flat until January CPI data comes in, at which point I expect an uptick in prices and long yields.

Treasuries: The Fed’s Treasury holdings were unchanged for the week-ended January 29th. This marks the second consecutive week that the Fed’s Treasury position is unchanged. The Fed’s Treasury holdings declined by $20.5 billion on a rolling 4-week basis.

Agencies: The Fed’s Government Agency security holdings declined by $12.3 billion for the week-ended January 29th. The Fed’s Government Agency holdings declined by $15.7 billion on a rolling 4-week basis.

The Fed’s balance sheet holdings: https://www.newyorkfed.org/markets/soma-holdings

Keep reading with a 7-day free trial

Subscribe to TEK2day to keep reading this post and get 7 days of free access to the full post archives.