The Fed’s Balance Sheet Reduction (QT) Update

The Fed’s lack of a consistent monetary policy is not helping market volatility. The Fed needs a consistent, conservative monetary policy to help foster a long-term stable Dollar and economy. Should the Treasury under Trump start to spend as it did under Biden, the Fed ought to increase its Fed Funds rate. That’s right. For every month Treasury runs a deficit, the Fed ought to jack up Fed Funds 25 BPS. Treasury and the Fed are supposed to be in natural conflict. However, under Bernanke, Yellen and now Powell, the Fed is subservient to Treasury and behaves as Treasury’s personal piggy bank - which is killing the Dollar’s purchasing power by way of expanding the money supply in part to absorb portions of new Treasury issues.

We expect lower short rates regardless of what Powell may say about “observing the data”. Short rates will come down in 2025. Long rates will be a function of fiscal spending and money supply growth.

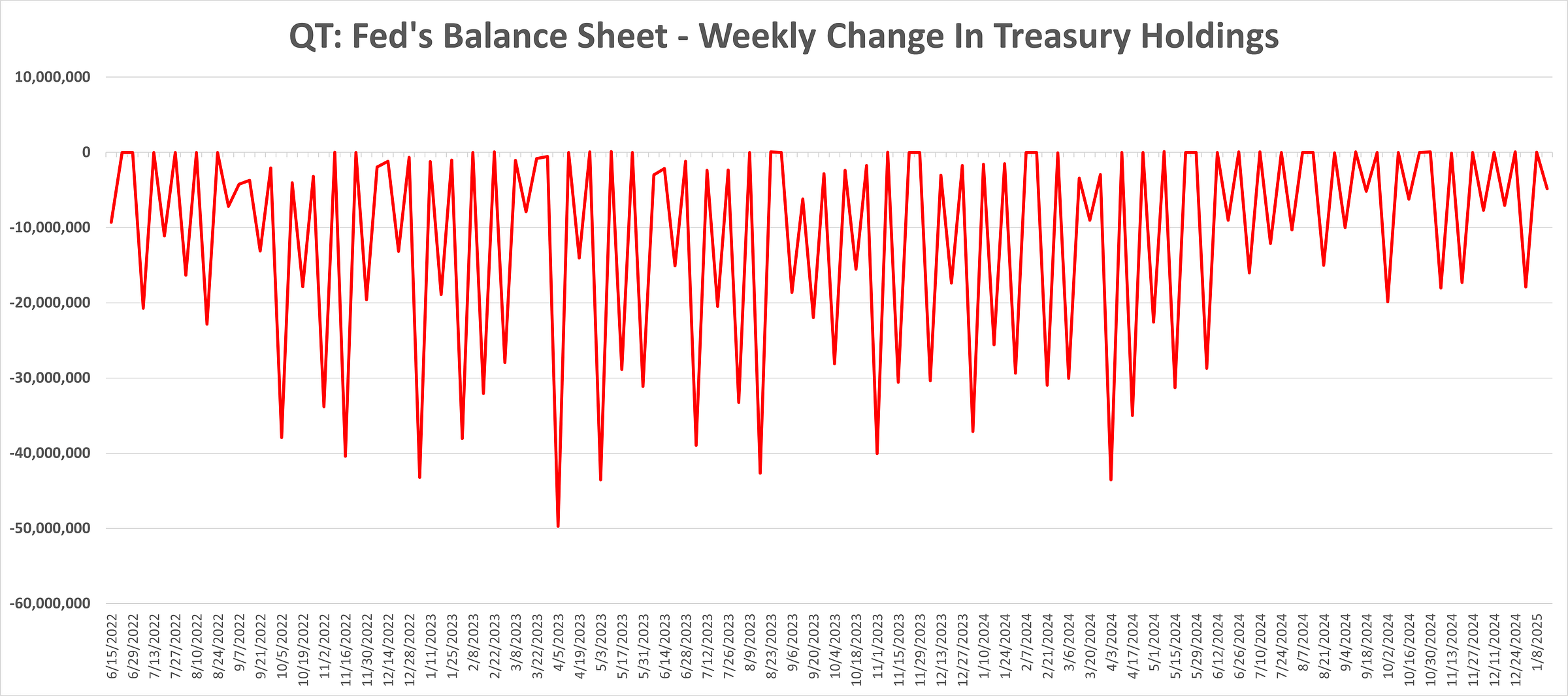

Treasuries: The Fed’s Treasury holdings decreased by $4.9 billion for the week-ended January 15th. The Fed’s Treasury holdings declined by $22.7 billion on a rolling 4-week basis.

Agencies: The Fed’s Government Agency security holdings declined by $58 million for the week-ended January 15th. The Fed’s Government Agency holdings declined by $15.6 billion on a rolling 4-week basis.

The Fed’s balance sheet holdings: https://www.newyorkfed.org/markets/soma-holdings

Keep reading with a 7-day free trial

Subscribe to TEK2day to keep reading this post and get 7 days of free access to the full post archives.