The Fed’s Balance Sheet Reduction (QT) Update

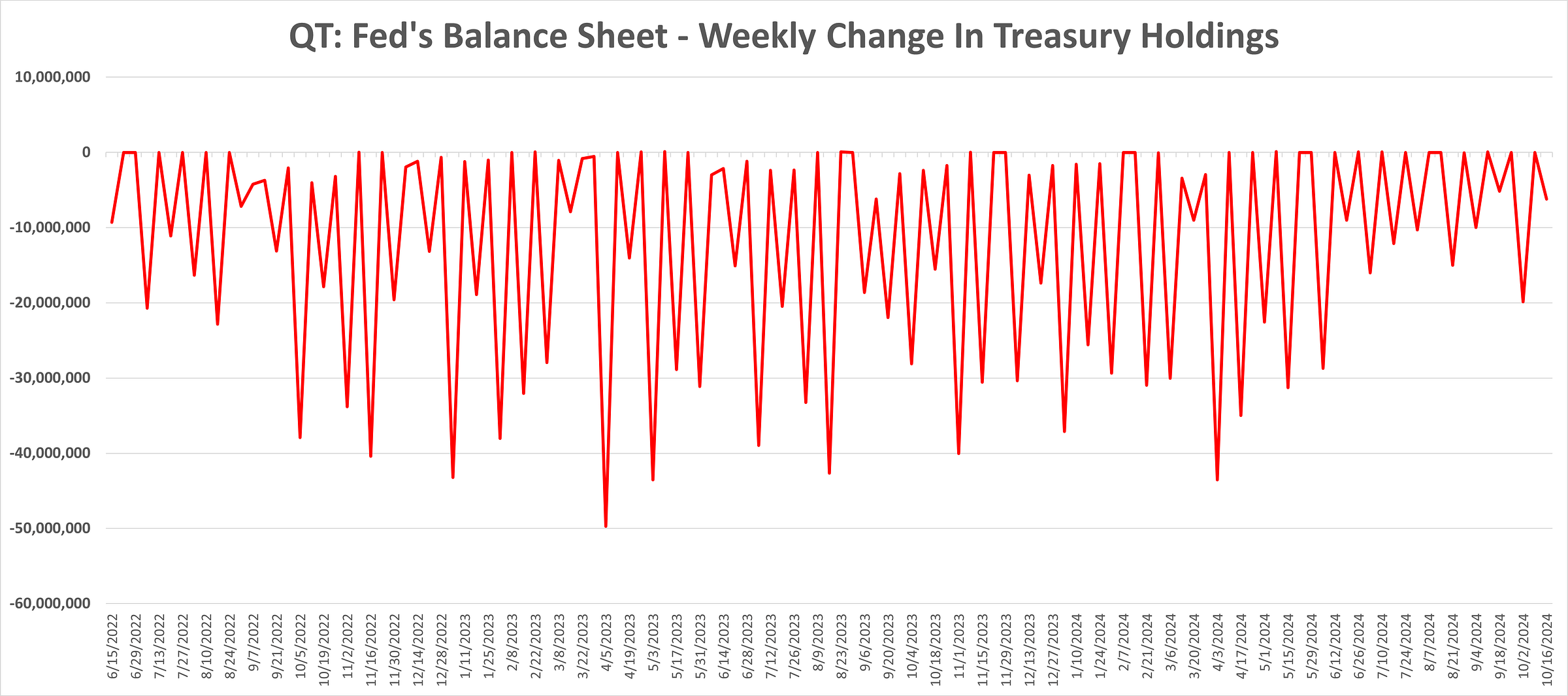

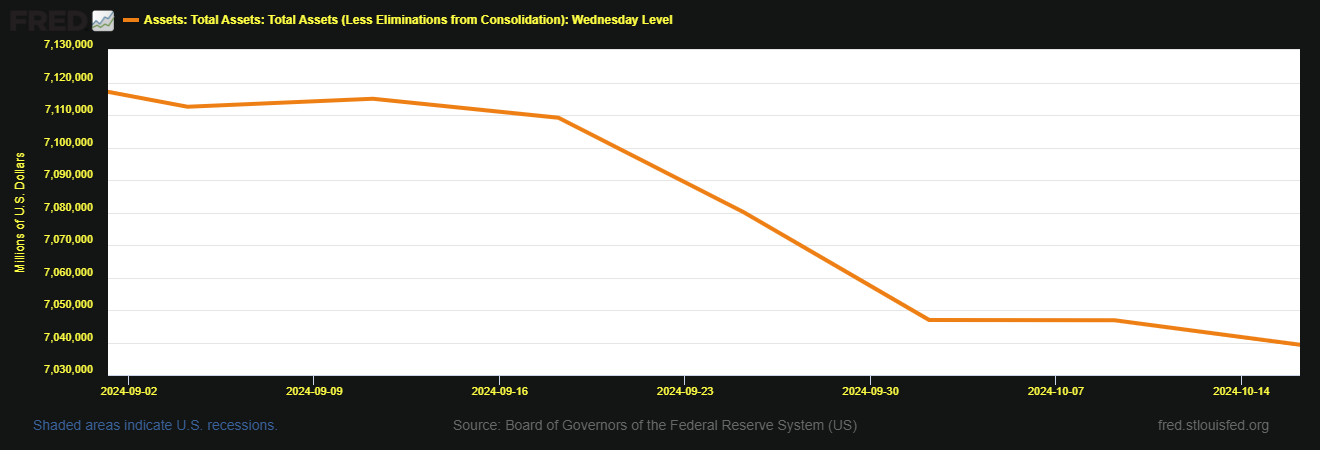

The Fed modestly reduced its Treasury position and added a small amount of mortgage-backed securities to its Balance Sheet the week-ended October 16th. The Fed has ended QT in my view and is now easing. The Fed’s Balance Sheet is leveling off after a modest decline over the past two years (see chart below). Additionally, I expect the Fed Funds rate to decline sharply next year as the U.S. can’t afford $36 Trillion in Treasury debt with an average interest rate north of 2%, much less where it sits today at 3.3%.

Treasuries: The Fed reduced its Treasury position for the week-ended October 16th by $6.2 billion. The Fed’s Treasury holdings declined by $26.1 billion on a rolling 4-week basis.

Agencies: The Fed increased its Government Agency security holdings by $10 million for the week-ended October 16th and decreased its Government Agency holdings by $17.6 billion on a rolling 4-week basis.

The Fed’s balance sheet holdings: https://www.newyorkfed.org/markets/soma-holdings

Keep reading with a 7-day free trial

Subscribe to TEK2day to keep reading this post and get 7 days of free access to the full post archives.