The Fed’s Balance Sheet Reduction (QT) Update

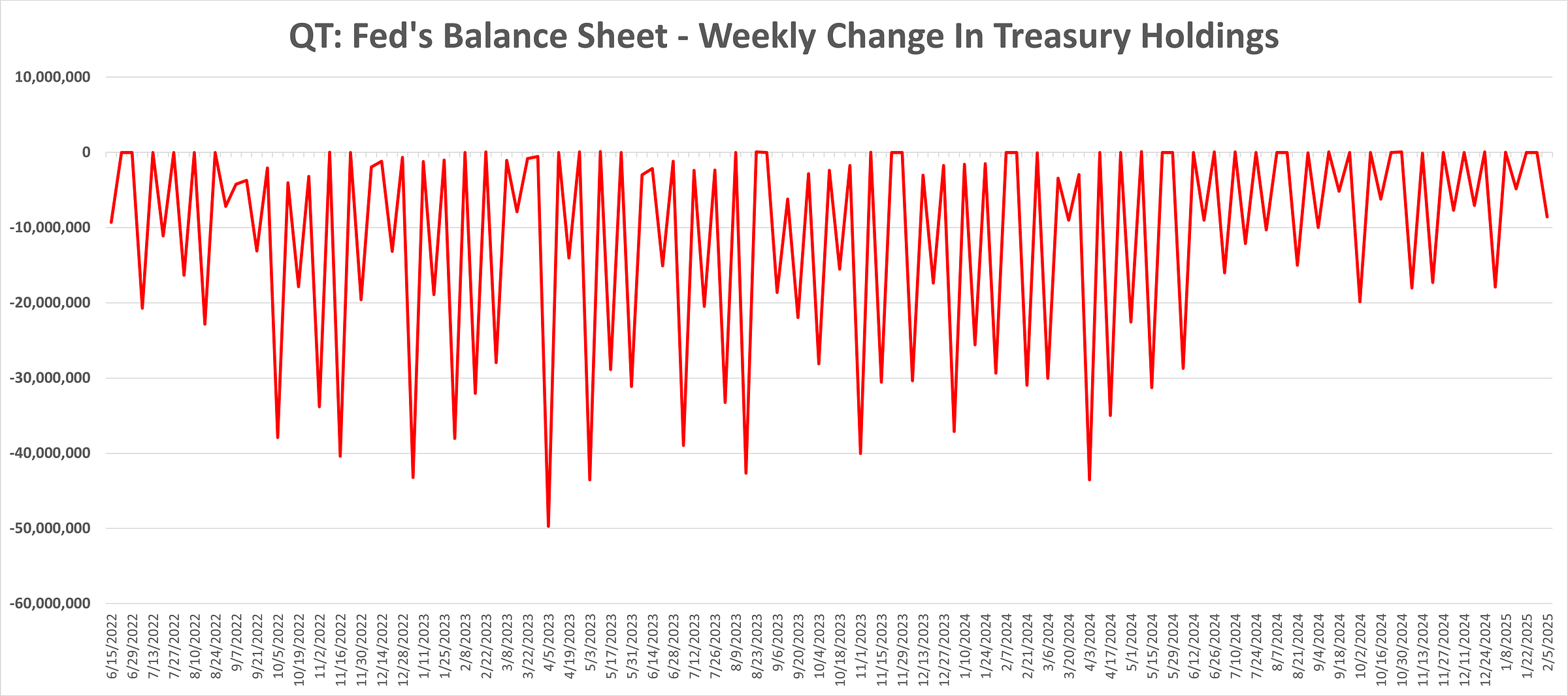

The Fed’s very modest tightening campaign that has persisted at these levels since mid-June 2024 continues. That does not mean that monetary policy is tight. I am in the camp that believes that the Fed Funds rate is below the real-world level of price increases, therefore Fed Funds at current levels does not offer a real rate of return, nor did it when it was at 5%. Further, the Fed shrinking its balance sheet by $20-30 billion per month for another number of months is not sufficient to move the needle.

Treasuries: The Fed’s Treasury holdings decreased by $8.6 billion for the week-ended February 5th. The Fed’s Treasury holdings declined by $13.4 billion on a rolling 4-week basis.

Agencies: The Fed’s Government Agency security holdings were unchanged for the week-ended February 5th. The Fed’s Government Agency holdings declined by $15.7 billion on a rolling 4-week basis.

The Fed’s balance sheet holdings: https://www.newyorkfed.org/markets/soma-holdings

Keep reading with a 7-day free trial

Subscribe to TEK2day to keep reading this post and get 7 days of free access to the full post archives.