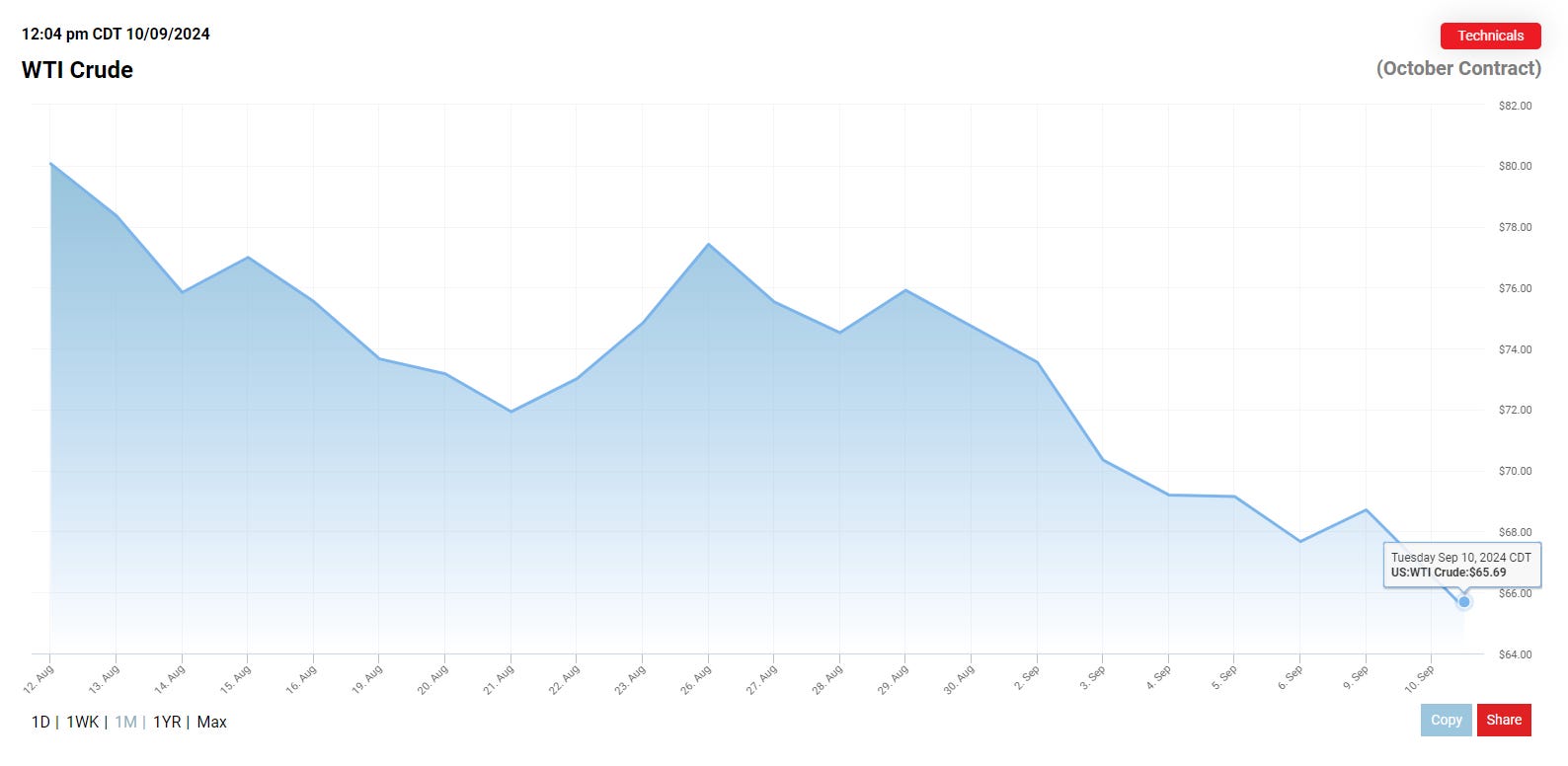

The Price of Oil Points to Economic Weakness, Not Natural Gas' Strength

I know that a number of people would say that Oil’s price weakness is due to consumption rotation into Natural Gas, but that feels like an excuse or a partial truth at best. Oil’s price weakness reflects consumer weakness, which means economic weakness is here for some time.

Too many investors are explaining away clear signs of economic weakness, as was the case in 2007 before the bottom fell out in 2008.

2025 will look different than 2008 because unlike 2008, Hank Paulson (fmr. Treasury Secretary) is not around to send the Capital Markets into a panic by collapsing an investment bank or two.

The great risk coming out of this next downturn will be an overly dovish response. (You must be a paid subscriber to see our fiscal deficit estimates for fiscal 2024 and 2025 below. Hint: 2024’s deficit will get a lot worse in September, and fiscal 2025’s deficit is likely to be at a record level by September 30th 2025).

Keep reading with a 7-day free trial

Subscribe to TEK2day to keep reading this post and get 7 days of free access to the full post archives.