We Built a Verisk (VRSK) Model

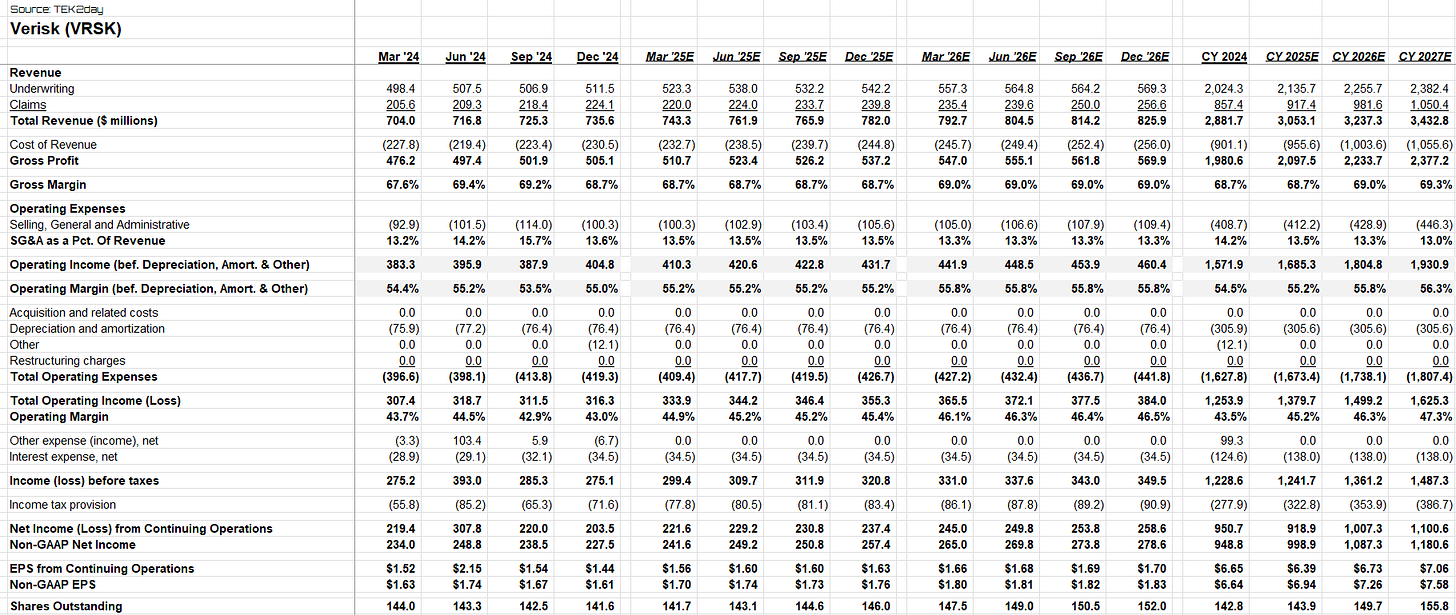

If you apply a 15x multiple to VRSK 2026E Operating Cash Flow or Free Cash Flow, you arrive at an Enterprise Value of approximately $20 billion at the mid-point.

If you apply a 20x multiple to VRSK 2026E Operating Cash Flow or Free Cash Flow, you arrive at an Enterprise Value of approximately $26 billion at the mid-point.

VRSK’s equity is currently valued at $42 billion, which implies a 32x multiple on 2026E Operating Cash Flow. This seems rich for a company that can be expected to grow Revenue and Cash Flow 6-9%.

I believe VRSK gets too much credit for its 50%-plus operating margins. This is primarily a function of a low cost of Sales and G&A, which is largely a function of Verisk’s history, having been founded by a consortium of insurers. VRSK’s cost of customer acquisition is low given that it lives off its long-time, multi-decade, core customer base. I give CEO Lee Shavel credit for focusing VRSK on its core. Building large new customer markets is not a VRSK core competency.

The Excel model is available behind the paywall.

Keep reading with a 7-day free trial

Subscribe to TEK2day to keep reading this post and get 7 days of free access to the full post archives.